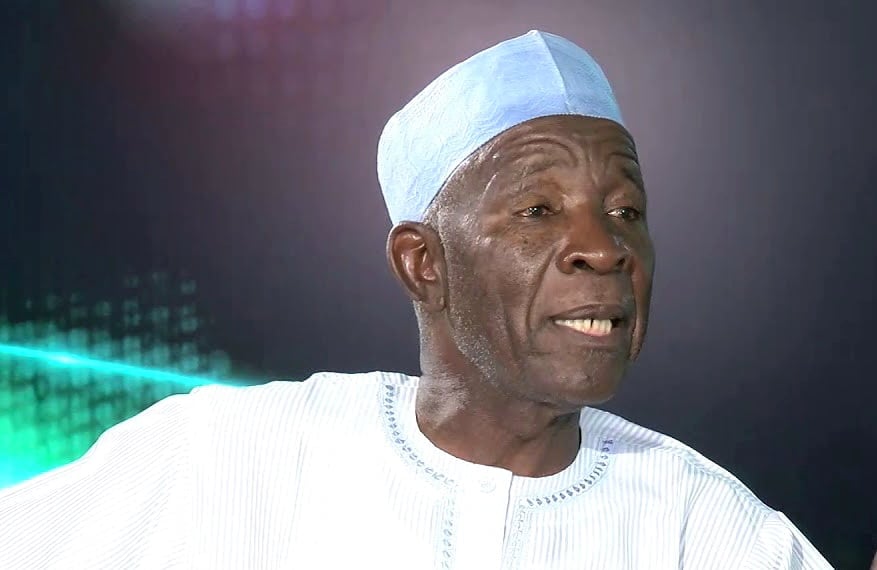

The diverse range of subscriptions from multiple investors (local and foreign) to Nigeria’s $2.2 billion Eurobonds is a testament of the confidence in President Bola Ahmed Tinubu’s economic reforms, Minister of Finance and Coordinating Minister of the Economy, Mr. Olawale Edun, said yesterday.

The Eurobond had been oversubscribed by 300 per cent by investors from the United Kingdom (UK), North America, Europe, Asia and Middle East as at yesterday.

According to the minister, the peak orderbook of $9.0 billion was an expression of continued investor confidence in Nigeria’s sound macro-economic policy framework and prudent fiscal and monetary management.

The demand for the bonds came from a combination of fund managers, insurance and pension funds, hedge funds, banks and other financial institutions.

Edun said: “The successful issuance signposts increasing confidence in ongoing efforts of President Bola Tinubu administration to stabilise the Nigerian economy and position it on the path of sustainable and inclusive growth for the benefit of all Nigerians.

“The broad range of investor appetite to invest in our Eurobonds is encouraging as we continue to diversify our funding sources and deepen our engagement with the international capital markets.”

Central Bank of Nigeria (CBN) Governor Olayemi Cardoso said the outcome underscored the growing confidence of investors and the resilience of the Nigerian credit.

He described the strong demand as Nigeria’s “improved liquidity position and continued access to international markets to support the financing needs of the government.”

Director-General, Debt Management Office (DMO), Ms. Patience Oniha said with the successful pricing of the bond notes on intra-day basis, Nigeria has registered a landmark achievement in the international capital market.

According to her, the size of the orderbook at approximately more than four times of the offer amount, and the strong and diverse investor base helped in pricing the new bond notes.

“The DMO remains committed to maintaining transparency and open communication with investors and stakeholders and appreciates the continued confidence and support of the international and Nigerian investors who participated in the pricing.”

Read Also: Fitch’s positive rating raises Nigeria’s Eurobond pricing prospect

She added that the new notes would be admitted to the official list of the UK Listing Authority and they are available for trade on the London Stock Exchange’s regulated market, the FMDQ Securities Exchange Limited and the Nigerian Exchange (NGX)

“The proceeds from this Eurobond issuance will be used to finance the 2024 fiscal deficit and support the government budgetary needs,” Ms. Oniha said.

Nigeria mandated Chapel Hill Denham, Citigroup, Goldman Sachs, J.P. Morgan and Standard Chartered Bank as Joint Bookrunners.

FSDH Merchant Bank Limited acted as Financial Adviser on the issuance.

The Eurobond attracted about $9 billion subscriptions in overwhelming show of enthusiasm by the international capital market for long-term investments.

The Eurobond offer, launched yesterday by the Federal Government, is the first in more than two years.

It offers two tenors of a six and half years and 10 years Eurobonds. Both medium-tenor and long-tenor bonds were massively oversubscribed.

Preliminary details showed that the order for the $700 million, 6.5 years bond had exceeded about $4.0 billion subscription, an oversubscription of 471 per cent.

Subscriptions for the long-term $1.5 billion, 10-year bond were in excess of $4.8 billion, indicating oversubscription level of 220 per cent.

The strong international demand has allowed Nigeria to tighten its coupon rates with the guidance rates for the 6.5 years and 10 years bonds at 9.625 per cent and 10.375 per cent respectively, a substantial discount to initial guidance.

Citigroup, Goldman Sachs, JPMorgan Chase, and Standard Chartered are headlining the $2.2 billion Eurobond sale.

Experts said the strong demand for the Eurobond was a vote of confidence by the international investing public in Nigeria’s evolving macroeconomic reforms.

Bloomberg stated that the strong demand was evident of the international investors’ views of the prospects of the ongoing economic reforms.

The foreign online platform added: “The sale reflects investors’ cautious optimism about President Bola Tinubu’s economic reforms, which include rolling back fuel subsidies and allowing the naira to float freely.

“These measures aim to tackle Nigeria’s chronic fiscal imbalances, but have fueled inflation and sparked a cost-of-living crisis for ordinary Nigerians.”

Managing Director, Arthur Steven Asset Management, Mr. Olatunde Amolegbe, said the subscription pattern reflected a positive outlook for the country.

He said: “The level of subscription we’ve seen so far is quite impressive, though we do not have the range of bids yet. This might indicate investors’ confidence in the economic reforms that are being implemented by the government.”

Amolegbe expressed optimism that the high level of interest could lead to lower borrowing cost for the government, as the parties finalise the book closure.

He however, noted the need to sustain fiscal reforms that prioritise prudence and effective utilisation of funds to optimise the benefits of the debt issuance.

Amolegbe stressed: “The need to borrow to finance infrastructure and other public spending is almost sacrosanct for most modern economies. However, debt sustainability needs to be at top of mind for the economy managers.”

Recently, the National Assembly approved the $2.2 billion foreign debt issuance as part of deficit financing for the 2024 Budget.

Analysts said a combination of positive outlook, attractive yields and search for portfolio diversification drove Nigeria’s Eurobond success.

Renaissance Capital Africa stated that it expects the bonds to attract strong demand, citing a “decent new issue premium” and investor appetite for scarce sovereign debt issuance from the region.

Samantha Singh-Jami, Africa strategist at Rand Merchant Bank, was quoted by Bloomberg as saying the bonds would “very likely to be well-subscribed, given the limited supply of sovereign issues in Sub-Saharan Africa and Nigeria’s ongoing reforms.”

The last time Nigeria sold Eurobonds was in March 2022. This year, African nations, including Ivory Coast, Cameroon, Senegal, Benin, South Africa, and Kenya, have returned to global markets after being sidelined by rising borrowing costs in 2022.

Nigeria has seen a surge in foreign direct and portfolio investments, with foreign portfolios trading at their recent highs at the Nigerian stock market.

Foreign portfolio investments (FPIs), which had become negligible, now account for about one-fifth of transactions at the Nigerian stock market.

©CDA News